The paid plan, called ChatGPT Plus #7

The paid plan, called ChatGPT Plus, comes two months after the tool was released publicly and quickly went viral, thanks to its ability to generate shockingly

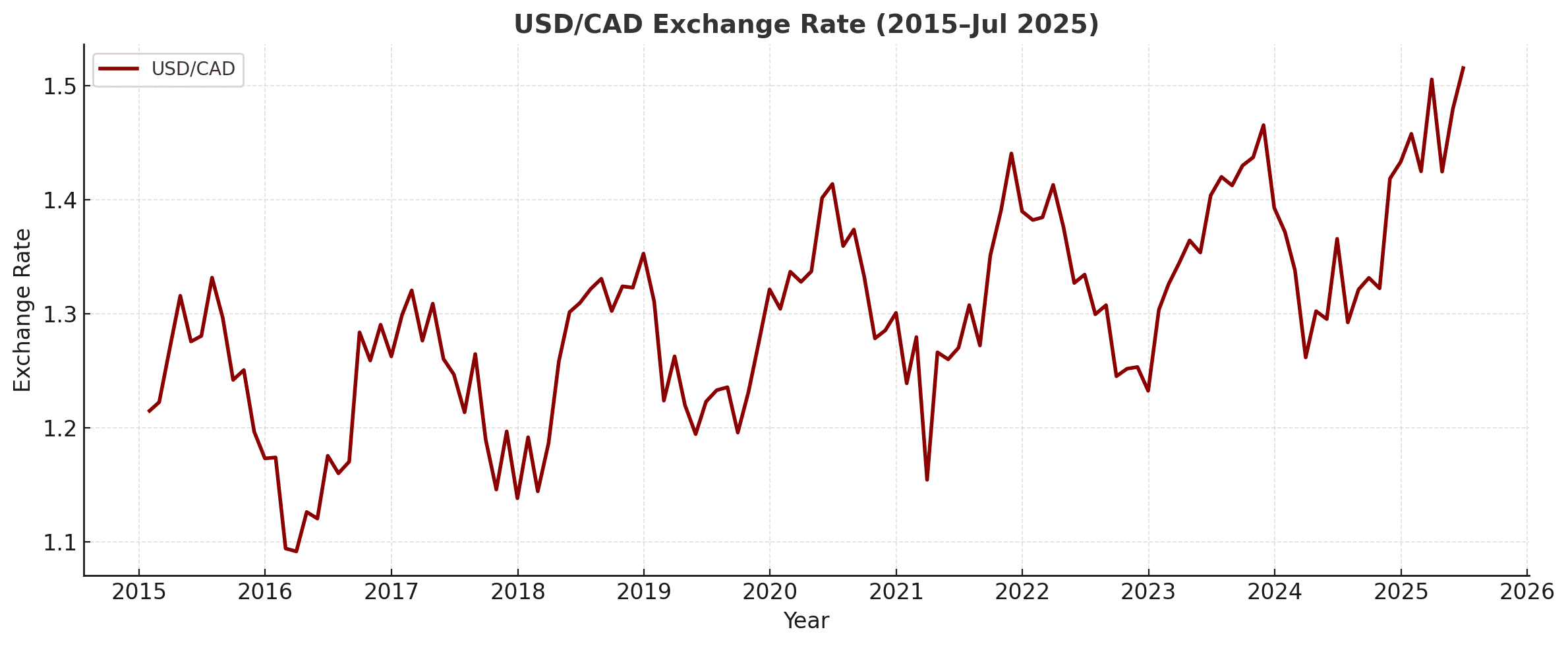

The Canadian dollar has continued to soften through 2025, trading around 1.38–1.39 per U.S. dollar. The move reflects a combination of slowing domestic growth, easing inflation, weaker oil prices, and a growing market expectation that the Bank of Canada (BoC) will lead global rate cuts ahead of the U.S. Federal Reserve.

Energy markets have also provided less support than usual. West Texas Intermediate (WTI) crude has struggled to hold above USD 70–75, reducing Canada’s terms-of-trade advantage. Meanwhile, housing-related slowdowns and cautious consumer spending have added to downward pressure on the loonie.

Most analysts expect the CAD to stay soft in the near term, with forecasts placing USD/CAD in the 1.36–1.40 range.

Key drivers:

• BoC easing cycle may begin earlier and move faster than the Fed

• Narrowing interest rate differentials are not expected until late 2025

• Volatile oil prices and slow global growth continue to restrict upside

• Persistent U.S. economic resilience keeps demand for USD elevated

As a result, the loonie is likely to remain under pressure until economic momentum stabilizes.

Conditions start to look more constructive looking forward. By 2026–2027, improving fundamentals may help the CAD regain lost ground.

Potential supports include:

• Inflation returning to target, giving BoC more policy flexibility

• Energy demand recovering as global manufacturing stabilizes

• Stronger Canadian export performance tied to a mild global rebound

• Policy alignment with the Federal Reserve, reducing USD yield advantage

Under these assumptions, analysts see USD/CAD moving toward the 1.32–1.35 range over the medium term.

• Stronger-than-expected U.S. growth could extend U.S. dollar strength

• Commodity price shocks or geopolitical disruptions

• Slower domestic recovery, especially in housing and consumer sectors

• Faster BoC rate cuts widening the policy gap with the Fed

Conversely, a firmer global recovery or a sharp rebound in energy markets could accelerate CAD strengthening.

The Canadian dollar is likely to remain soft in the short term as Canada adjusts to slower growth, softer inflation, and shifting monetary policy. However, improving fundamentals over the next two years support a gradual CAD recovery through 2027.

The paid plan, called ChatGPT Plus, comes two months after the tool was released publicly and quickly went viral, thanks to its ability to generate shockingly

The paid plan, called ChatGPT Plus, comes two months after the tool was released publicly and quickly went viral, thanks to its ability to generate shockingly

The paid plan, called ChatGPT Plus, comes two months after the tool was released publicly and quickly went viral, thanks to its ability to generate shockingly